Planning for retirement can be hard. When you retire, you make the choice to leave the workforce for good. However, when you leave the workforce, you leave your source of income. Without this money coming in, it will be hard to handle your bills if you didn’t properly prepare for this time. That is why it is important to know about different retirement accounts. An IRA is an Individual Retirement Account and there are two common types. There are Traditional IRAs and Roth IRAs. Each option can benefit a person in a different way. That is why you want to learn the difference so that you can find the option that is better for your goals when you retire.

What is a Traditional IRA?

A Traditional IRA is a type of individual retirement account that gives people the ability to put pre-tax income towards investments. These investments will then grow tax-deferred. The Internal Revenue Service (IRS) will not assess capital gains or dividend income taxes on these accounts until the beneficiary takes out funds. Taxpayers have the ability to also contribute all earned compensation (up to a specific maximum amount of dollars). There may be income thresholds that apply. Contributions (also known as deposits) made to a Traditional IRA could also qualify as a tax deduction depending on factors like how much the taxpayer makes, tax-filing status, and more.

How Do These Accounts Work?

A Traditional IRA is a type of account that gives individuals the ability to put pre-tax income into a retirement investment account. The funds in this account can grow tax-deferred until retirement withdrawals happen. These withdrawals should take place when the beneficiary is 59 years and 6 months old or older.

Oftentimes, the contributions to a Traditional IRA can be considered as a tax deduction. For example, if a person contributes $5,000 to their IRA then they can claim that amount as a tax deduction on their income tax return. That is basically like tax savings, right there! It’s an example of tax savings because it reduces your tax burden because they can be seen as a tax deduction.

The best part? The IRS will not apply income tax to that earning amount! However, it is important to keep in mind that when a person takes out money from the account during their retirement, the withdrawals will deal with the standard income tax rate. That means you will need to pay taxes!

The IRS has limits on how much a person can deposit into their Traditional IRA annually. Their limits depend on the age of the account holder. For example, the 2021 (and 2022) contribution limit is $6,000 for individuals younger than 50 years old. On the other hand, the 2021 (and 2022) contribution limit is $7,000 for individuals older than 50 years old.

Understanding Traditional IRA Distributions

A distribution is just another fancy way to talk about when you take out money like a withdrawal of the funds from your account. When you receive a distribution from your Traditional IRA, the IRS will view that money as standard income which means it will be subject to income tax. Individuals that have a Traditional IRA account can take out distributions as soon as they are 59 years and 6 months old. However, it’s important to keep in mind that once an account holder is 72 years old, they will need to take required minimum distributions (RMDs) from their account.

If there are funds removed before the full retirement eligibility then they can deal with a penalty that’s worth up to 10% of the amount withdrawn as well as other taxes at the standard income tax rate. Luckily, there are exceptions to these penalties. Exceptions can include:

- The funds are used towards buying or rebuilding a first home for the account holder or an eligible family member (with the limit of $10,000 per lifetime).

- The account holder becomes disabled before the distribution happens

- In the event of the account holder death, the beneficiary receives the assets

- The assets are used for unreimbursed medical expenses

- When the distribution relates to the Substantially Equal Periodic Payment (SEPP) program

- The assets go towards qualifying higher education costs

- Assets that go towards costs of having a child

- Assets that go towards costs of adopting a child

- The account holder uses the assets to handle the cost of medical insurance if they lose their job

- When the distribution relates to an IRS levy

- The distribution amount is a return on non-deductible contributions

- The account holder is in the military and are called to active duty for over 179 days

If you want to confirm whether or not your situation will result in tax penalties, you will need to talk to a professional like a tax attorney. You could even reach out to the IRS for help!

Pros and Cons of a Traditional IRA

Everyone can find their own benefit in this type of retirement account. However, There are two specific benefits to keep in mind:

- Lower Your Federal Financial Obligation: Depending on your income, you may have the option to deduct your contributions on your taxes. When you do this, you would lower your annual earnings which lowers your federal financial obligation.

- Delay Your Tax Bill: The funds in your Traditional IRA account will grow and you will not have to deal with paying taxes on it during that growth period. You will need to worry about taxes when you begin making withdrawals when you are in retirement.

While there are some nice benefits that come along with this type of retirement account, there are some cons that you want to keep in mind! A couple of cons to keep in mind includes:

- Withdrawal Money Requirements: If you have a Traditional IRA you will need to make a withdrawal when you are 72 years old. The IRS will determine the minimum amount you will need to take out.

- Potential Penalties: If you try to take out money earlier than you are supposed to then you can expect to deal with taxes. That’s because the funds that you withdraw will be considered in your annual taxable income. It’s also important to note that generally you will have to pay a 10% penalty unless you meet exceptions to the rule.

What is a Roth IRA?

Another type of IRA is a Roth IRA. This type of individual retirement account gives people the opportunity to take out eligible tax-free withdrawals. It’s important to note that certain conditions must be met in order for the withdrawals to be tax-free! This type of retirement account is funded with after-tax dollars. That means that the money that an individual deposits is not tax-deductible. However, once you start taking out money, the funds are tax-free! The money that you invest in these accounts will grow tax-free as well. This type of account has less limitations as there is no required minimum distribution (RMD)!

When people put money into this account, they can use funds from a variety of different sources like:

- Conversions

- Standard contributions

- Rollover contributions

- Spousal IRA contributions

- Transfers

All standard Roth IRA contributions will need to be made in cash. However, that includes checks and money orders. There are limits around what can be used. For example, securities or property can not be a contribution. The IRS will limit how much a person deposits annually and can adjust the amounts regularly. The limit of how much someone can deposit depends on the age of the account holder. For example, the 2021 (and 2022) contribution limit is $6,000 for individuals younger than 50 years old. On the other hand, the 2021 (and 2022) contribution limit is $7,000 for individuals older than 50 years old.

How Do These Accounts Work?

When establishing a Roth IRA, it needs to be with an institution that has approval from the IRS to provide IRAs. There are plenty of different places like:

- Banks

- Brokerage companies

- Federally insured credit unions

When opening an account people typically tend to go through IRA brokers. These accounts can be established whenever. However, any contributions for a specific tax year must be deposited by the IRA holder’s tax-filing deadline. For the 2021 tax year the deadline is on April 18th, 2022. When establishing a Roth IRA, there are two documents that you can expect to receive:

- IRA disclosure statement

- IRA adoption agreement and plan document

These documents will explain the rules and terms that you will need to deal with when you establish a Roth IRA. The agreement is between the IRA holder and the IRA custodian/trustee. You will want to review different financial institutions when trying to decide where to establish your Roth IRA. That’s because different places have different opportunities available.

Pros and Cons of a Roth IRA

Just like a Traditional IRA, a Roth IRA has its own set of pros and cons that can benefit a person who is saving for retirement. Some benefits that come along with this type of retirement account include:

- You Can Keep Your Withdrawals: A big benefit to this type of account is the fact that the funds that grow in a Roth IRA are tax-free. That means earnings are not going to be subject to more taxes!

- No Withdraw Requirements: There is no requirement that says the account holder needs to take any money out of a Roth IRA regardless of age.

While a Roth IRA has some nice benefits, there are some cons to keep in mind. Some of the drawbacks that come along with this type of account includes:

- No Benefits Right Away: It’s a waiting game to feel the benefits of these types of accounts. There will not be instant gratification when it comes to taxes!

- Can be Tempting: Since it is easy to take out funds from a Roth IRA, it can be tempting to take out money. However, this money is in your retirement account so when you take out those funds then you are reducing how much you will have when you retire.

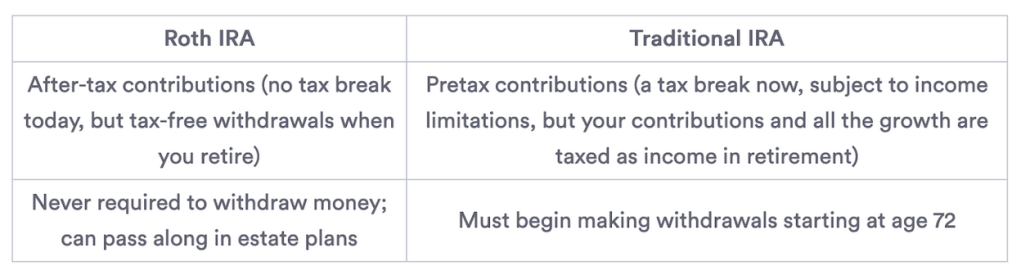

Roth IRA vs Traditional IRA: An Overview

Even though both of these are IRAs, they are not the same type of account. You will want to compare these options so that you can get a better understanding of these retirement accounts! A Traditional IRA is an account that can help you potentially get a tax break quickly while helping you save for retirement. When you contribute funds to your Traditional IRA, you may have the opportunity to deduct the contribution amount from your tax return. The amount of funds that you can contribute will have limits depending on your age. There will be a withdrawal requirement once you turn 72 years old.

On the other hand, Roth IRAs cannot provide tax benefits quickly. That’s because the money that you contribute is after-tax. That means that until you start making tax-free withdrawals, you won’t see benefits. That’s due to the compounded growth that builds up over the years. The amount of funds that you can contribute will have limits depending on your age. However, there is no withdrawal requirement for these types of accounts regardless of how old you are!

Which is Better: A Traditional or Roth IRA?

When trying to decide between a traditional or Roth IRA, you will want to take notice of key differences. The biggest differences are around these factors:

- Taxes

- Timing

When it comes to taxes, a Traditional IRA has potential for a tax benefit sooner rather than later. On the other hand, a Roth IRA means there is no benefit immediately but instead you will see benefits when you withdraw money down the line.

When it comes to timing, a Traditional IRA has required minimum distributions (RMDs). On the other hand, those that have a Roth IRA can withdraw money at any time and do not have any RMDs. Bankrate has a table that shows the differences between these accounts:

The better option will depend on what goals you are trying to achieve. For example, if you want to hold off on making withdrawals regardless of age then you may not want a Traditional IRA. That’s because a Traditional IRA has the requirements for people to start withdrawing funds at 72 years old. Other factors that you will need to consider when deciding between IRAs includes how much you want to contribute every year, your long-term retirement goals, your tax preferences, etc.

Is it Smart to Have Both a Traditional and Roth IRA?

As long as you meet all the requirements, you have the ability to contribute to both a Roth IRA and Traditional IRA. This can give you the opportunity to reap the immediate benefits from a Traditional IRA and long-term benefits from a Roth IRA. If your income changes then you may need to see that your eligibility will change for your Roth IRA. You may find that it’s smart to open different types of accounts if you want to benefit from their different features.

Special Considerations to Keep in Mind About a Roth IRA vs a Traditional IRA

Some special considerations that you will want to keep in mind includes your:

- Age: If you are in the early stages of your career, you will want to take into consideration how that will impact your benefits for Roth IRAs and Traditional IRAs. The longer you have between the present and your retirement, then the more potential compounded tax-free growth you could see with a Roth IRA.

- Family History: When people think of the age of retirement, they typically think of being 65 years old. However, people can work past that. In fact, if your family has a history of living for a long time, you may be expected to work until you are 75 years old! Since Roth IRAs don’t have any withdrawal requirements, you may find that this is a better option when it comes to the future of your retirement.

Commonly Asked Questions About a Traditional or Roth IRA

When learning about different retirement accounts, you may have some questions. Other people have had questions as well because this topic can be hard to understand.

Do You Need to Pay Taxes on Roth IRAs?

If you don’t want to pay taxes on your Roth IRA then the distribution will need to have happened at least 5 years after the account holder established and deposited funds into their first Roth IRA. Besides that fact, the distribution will also need to happen under one of the following conditions:

- The account holder is at least 59 years and 6 month old when the distributions are taken out.

- The funds are used towards buying or rebuilding a first home for the account holder or an eligible family member (with the limit of $10,000 per lifetime).

- The account holder becomes disabled before the distribution happens

- Assets go towards costs of having a child

- Assets go towards costs of adopting a child

Non-Qualified Distributions

If the distribution does not meet the conditions above, then it is a non-qualified distribution. These types of distributions are taxable (which means you will need to pay taxes). They may deal with income tax and up to a 10% penalty. However, there are exceptions when it comes down to determine whether or not a Roth IRA distribution will be taxable. Exceptions where funds go towards the following can avoid dealing with tax and penalty fees:

- Unreimbursed Medical Expenses: If the funds go towards this expense then the distribution must be more than 7.5% of the person’s adjusted gross income (AGI) for the 2021 tax year (and tax years prior).

- Medical Insurance: If the person lost their employment.

- Qualifying Higher Education Costs: Types of qualifying higher education expenses are fees, tuition, supplies, books, and more. The funds from the distribution must be used in the year that they are taken out!

- Adoption Expenses or Childbirth Expenses: Only if the distribution was made within one year of the event and is not over $5,000.

A Roth IRA vs Traditional IRA: How Many Can You Have?

You can have as many Roth IRAs and Traditional IRAs that you want. However, you may run into brokerage limits depending on the account type. You have the option to choose another brokerage though if you run into these limits.

What is Taxable Income for a Traditional and Roth IRA Account?

When you think of taxable income for an IRA, you want to make sure you understand what this means! Contributions that you make to a Traditional IRA may be tax-deductible depending on factors like your income and filing status. Typically, amounts in your Traditional IRA are not seen as taxable income until you take a distribution from your IRA.

Bottom Line on Traditional and Roth IRA Accounts

When it comes to planning your retirement, there are plenty of different accounts to consider. Two popular options are Roth IRAs and Traditional IRAs. Even though both of these are IRAs, they are not the same type of account. You will want to compare these options so that you can get a better understanding of these retirement accounts! Traditional IRAs are accounts that can help you potentially get a tax break quickly while helping you save for retirement. When you contribute funds to your Traditional IRA, you may have the opportunity to deduct the contribution amount from your tax return. The amount of funds that you can contribute will have limits depending on your age. There will be a withdrawal requirement once you turn 72 years old.

On the other hand, Roth IRAs cannot provide tax benefits quickly. That’s because the money that you contribute is after-tax. That means that until you start making withdrawals, you won’t see benefits. That’s due to the compounded growth that builds up over the years. The amount of funds that you can contribute will have limits depending on your age. However, there is no withdrawal requirement for these types of retirement accounts regardless of your age!

The better option will depend on what goals you are trying to achieve. For example, if you want to hold off on making withdrawals regardless of age then you may not want to consider Traditional IRAs. That’s because a Traditional IRA has the requirements for people to start withdrawing funds at 72 years old. Other factors that you will need to consider when deciding between IRAs includes how much you want to contribute every year, your long-term retirement goals, your tax preferences, etc.

Article References

https://www.investopedia.com/terms/t/traditionalira.asp

https://www.bankrate.com/investing/traditional-ira-vs-roth-ira/

https://www.investopedia.com/terms/r/rothira.asp

https://www.investopedia.com/ask/answers/03/081503.asp#toc-traditional-ira-or-roth-ira-how-to-decide

https://www.merrilledge.com/ask/retirement/how-many-iras-can-you-have

https://www.irs.gov/retirement-plans/traditional-iras